In this post, you’ll learn about the best drone liability insurance in Canada. Plus 6 things to know before you decide if you need insurance, and which policy is the right one for you.

Flying a drone brings a whole set of government requirements – like pilot exams and certificates, maintenance and flight logs, and even Special Flight Operations Certificate (SFOC) for some operations.

But what liability does piloting a drone in Canada expose you to? It’s worth considering before you need coverage.

Choosing the Best Drone Liability Insurance in Canada

As with any form of insurance, there are many details and factors to consider when determining if you need it. And if so, what specific coverages are needed?

In this section, I’ll answer many common drone insurance questions.

Later, I’ll share the specifics of my insurance policy. And the 6 best providers of drone liability insurance in Canada.

1. Does Transport Canada Require Drone Insurance?

No, drone insurance isn’t required by Transport Canada.

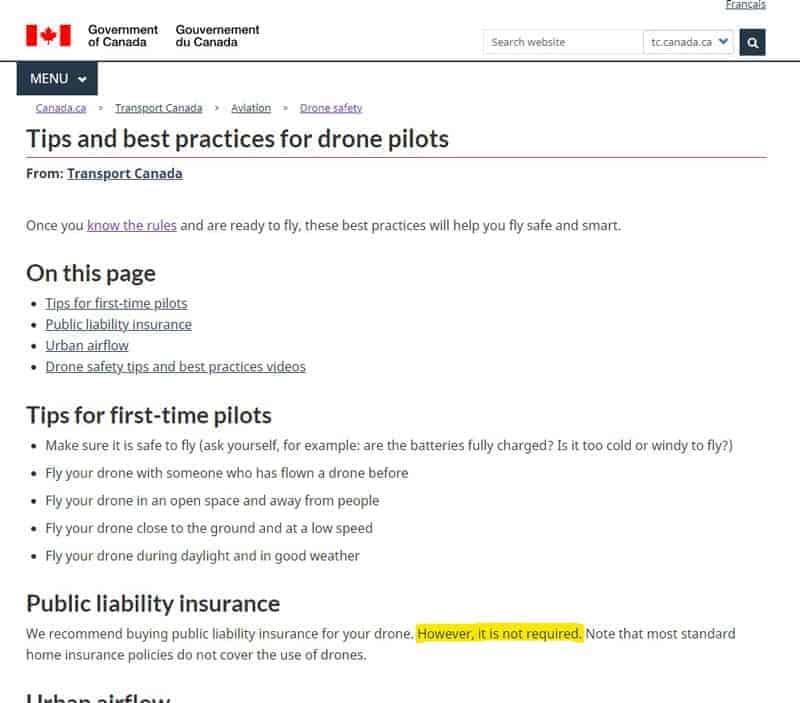

Here is their position, in a screenshot from June 2021:

Here’s what they have to say:

Public liability insurance

We recommend buying public liability insurance for your drone. However, it is not required. Note that most standard home insurance policies do not cover the use of drones.

This is an important detail. Some insurance providers claim that it is required by Transport Canada, which is untrue. Canada’s drone laws don’t require any insurance.

Is there a $100,000 insurance requirement? Some sources state a Transport Canada requirement of $100,000 insurance coverage for drones weighing over 250 grams. But these articles are out of date.

This one (published February 8, 2018) on Canadian Underwriter states this requirement. But the Canadian drone laws were overhauled in June 2019. So this insurance requirement must be a relic of previous, now defunct, legislation.

2. Do I Need Drone Liability Insurance?

Yes, you need insurance. While it isn’t required by law, protecting yourself from lawsuits is always a good idea.

A personal injury lawsuit can easily reach $100,000 or more. According to one Canadian law firm, the average settlement for an auto accident in Canada is $120,000. And while they differ in mechanics, drones also carry the potential to cause personal injury and thus attract a personal injury lawsuit.

In Ontario, there is a cap of $20,000 for awards on the tort of intrusion upon seclusion. According to Canadian Underwriter, there are four criteria that need to be proved under the charge of breach of privacy. And in Canada’s first drone case, Dentons explain some of the liability risks involved in flying drones.

We insure our homes, our cars, and our health. It is probably a good idea to insure a flying vehicle with rotating blades traveling at 50 km/h.

For me, just the peace of mind is worth it.

3. Are Drones Covered in Commercial Insurance Policies?

When I checked with our commercial insurance provider, they advised that drones are listed as an exclusion. And our policy is specific to media companies – and they exclude drones.

Because most businesses have no need for this type of coverage, drones are often specifically excluded in commercial insurance.

This was my situation. My broker had to look for another company that would write coverage for drones.

Don’t assume your commercial policy will cover commercial drone use. Ask before taking off.

4. Does My Home Insurance Cover Drone Liability?

Probably not. According to Christina Polano, partner with Thomas Gold Pettingill, aircraft is specifically excluded in the wording of most home insurance policies.

In fact, home insurance often excludes aircraft as a category. Which, by definition, also includes drones. This means that if your drone is stolen from your home or lost in a house fire, it probably isn’t covered by your homeowner’s insurance.

5. What Does Drone Insurance Cover?

There are two things you can insure with a drone policy in Canada.

- Gear: Just like collision coverage on your car, you can insure your drone against damage and loss. Often this will cover flyaway, theft, and disappearance.

- Liability: Get coverage for bodily injury and property damage. Liability limits range from $100,000 to $5,000,000.

Obviously, the most important insurance to have on your drone in Canada is liability insurance. The price of your drone (even a really good one) is a rounding error on a personal injury lawsuit.

Other riders can be added, like flying indoors, worldwide coverage, higher personal injury limits, etc. Privacy coverage is an important factor to consider.

Many policies also cover a single operator. You can add additional individuals, like a co-pilot, client, or repair shop.

6. How Much Does Drone Insurance Cost?

Canadian drone insurance costs as low as $132.00 per year, for $100,000 of liability coverage. Increase the liability limit to $1,000,000 and the premium is $264.00. Both policies include an additional $500 in medical expenses. These costs are based on Skywatch, and are current in June 2021.

As with most insurance, there is a wide range of coverage and premium costs.

And in addition to premium costs and coverage levels, it’s important to trust that your policy will actually pay out a claim.

More reading: Guide to GoPro Drones

3 Best Options for Drone Insurance Canada

As I researched liability coverage from my drone, here are the best providers I discovered. If you know of other carriers, please let me know in the comment section below.

1. Skywatch.ai

- Covers both commercial and recreational

- Covers Canada and USA

- Primary Benefit: On-demand insurance coverage.

- Quote: Online. For standard requirements, you can get an instant quote online and purchase the policy in a few minutes.

- Limitation: Available only to residents of Alberta, British Columbia, and Ontario.

Skywatch is one of the most talked-about drone insurance providers. With Skywatch, you can buy hourly, monthly, or annual plans. This is great for hobbyists and professionals.

On their quote page, you can choose from the following variables.

- Variable liability limit: $100K, $500K, $1M, $2M, $5M.

- Physical Damage Coverage (Hull). Optional. You can enter the year, model, serial number, and photo of your drone. This coverage protects against physical damage, loss, or theft. Coverage includes flyaway.

- Additional Coverages: Indoor flights, increased personal injury coverage, increased medical expense, and adding US coverage.

- Additional Insured: Insure your client, repair shop, venue, other insurance brokers, etc.

The base rate includes coverage for all of Canada. And they offer discounts of up to 30% for safe pilots.

2. Air1 Insurance

Air1 Insurance is based in Langley, BC. They have been in the aviation insurance business since 2006 and the principals are both

Their application form is very detailed and asks for pilot experience, training, details on the specific drone model, maintenance, and much more. This is clearly for commercial applications.

Request a quote from Air1 Insurance.

3. CoverDrone

Based in the UK, CoverDrone is much like Skywatch. They are an online drone insurance provider. They claim to be the biggest insurer of commercial drones on the market.

I’m not sure by which metric they are measuring, but it is clear that they have a decent market share.

From what I can tell, they don’t actually sell insurance but are a referral network to other providers.

- Covers both commercial and recreational

- Covers Canada. Also the UK, EU, Australia, and New Zealand.

- Primary Benefit: Their policy has no limitations on the number of drones and operators in your business.

- Quote: Online. You’ll have to submit your details and they’ll get back to you with a quote.

Here’s the message I received after requesting a quote online.

Get Coverdrone quote: Commercial or Recreational

They have a 4.8/5 star rating on Feefo, based on 1200+ reviews.

So there you have it. Our picks for the three best drone insurance options in Canada.

Now, let’s look at an additional 6 drone liability insurance companies here in Canada.

6 Drone Insurance through Brokers

The following drone insurance companies all offer coverage for RPAS in Canada. But to purchase them, you’ll need to deal with one of their broker companies.

In many cases, you might be able to purchase this from the same broker where you buy your home or commercial insurance.

4. CAIG (Canadian Aircraft Insurance Group)

In the USA, it’s known as USAIG (United States Aircraft Insurance Group).

- Focuses on commercial drone operation

- Covers Canada and USA

- Primary Benefit: They are an aviation insurance company. So they understand manned and unmanned aircraft.

- Quote: Through insurance brokers. If your insurance company can’t find an insurance provider, recommend they contact CAIG.

Because of their distribution structure, you can’t get a quote directly. It will take longer and likely cost more to purchase through this company. But they are an established aviation insurer here in Canada.

5. Intact Insurance

Intact Insurance is a large Canadian insurance company. Back in January 2016, they launched commercial drone liability coverage. Read their launch press release. To get a quote, you’ll need to request it through a broker.

Details about what they actually offer are minimal.

6. Armour Insurance

Canadian-based Armour Insurance offers drone insurance in Alberta and Saskatchewan only.

Get a quote from Armour Insurance.

7. HUB International

Back in 2018, HUB International wrote a few blog posts about drone liability and rules. Since then, the rules have changed. They have a division focused on insuring entertainment and creative projects.

HUB International sells its policies through brokers. You can’t buy drone coverage directly through them.

8. CapriCMW

Based in Burnaby, BC, CapriCMW offers standard drone liability and hull coverage.

Their sales page for drone insurance, states that liability coverage is a Transport Canada requirement. Which it isn’t. I reached out to them and I’m still waiting to hear back. I’ll update the post with their response.

Be careful buying from insurance providers who don’t know the current rules.

9. Drone Insurance Depot

This service seems sketchy. Their site links to a Facebook page that has been deleted. And their Twitter account has been dead for 3 years. Not a good sign. I won’t link to them, as they also aren’t well-reviewed by other drone bloggers. If this changes, I’ll update this listing in the future.

Keep Reading: Check out our Drone Pilot Glossary

Your Turn

Which drone insurance provider did you choose? Are you using another Canadian insurance provider for your RPAS? I would love to hear what’s working for you.

- About the Author

- Latest Posts

Hey, I’m Bryan! I’m a content creator and co-founder of Storyteller Tech.

Experienced GoPro Videographer: I’ve been shooting with GoPro cameras for over 11 years. My first GoPro was the Hero3 Silver, bought for a Galapagos work trip in 2012. Today I own 20+ action cameras, including GoPro, DJI, and Insta360 cameras.

Professional Creator: Dena and I have developed video and content marketing plans for numerous international travel brands. And we also run several content businesses.

Bryan also creates at Storyteller.Travel and is co-founder of Storyteller Media, a Canadian-based publishing company.

robert

Wednesday 14th of December 2022

Thanks for your article. I'm glad I checked out sky watch. Great plans and very flexible. Fantastic for operators just starting out.